When you have to pick between owning a house and the dream of financial independence, I’d like to call the following thought experiment “House FIRE.” (Terrible pun, I know)

$1 million home vs. $1.5 million portfolio

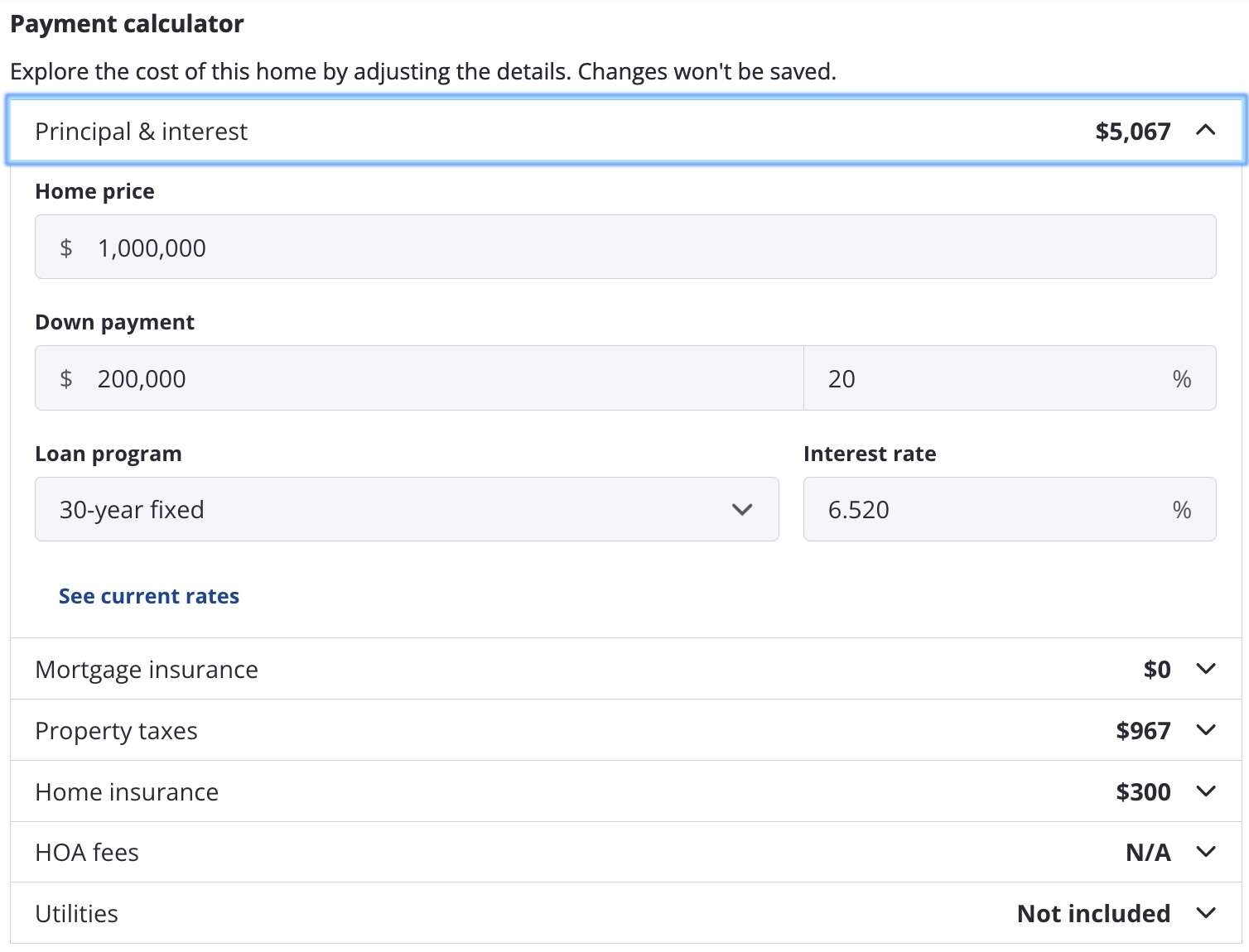

Many people (ok, me) want a single-family home in a decent Los Angeles neighborhood—something with at least three bedrooms, near good public schools, and plenty of sunshine. Then I ran the numbers:

- Average L.A. home price: ~$1 million

- 20% down payment: $200,000

- Mortgage + taxes + insurance: roughly $5,000/month.

On the other side of my spreadsheet is a very common financial independence goal:

$1.5 million invested, assuming the 4% rule, yields $5,000/month over ~30 years.

For those new to it, the 4% rule suggests that if you withdraw about 4% of your investment portfolio each year, you can (hopefully) sustain your lifestyle for a few decades without running out of money.

- $1 million → $3,333/month

- $1.5 million → $5,000/month

- $2 million → $6,666/month

So why use $1.5 million as a benchmark portfolio number?

Because $5K/month is about what the average household in America spends. If your living costs are covered by your portfolio, then you’re financially free!

But this $1.5 million FI portfolio is the same monthly amount you’d need to carry a million-dollar mortgage in L.A.—before factoring in repairs, property tax hikes, and potential disasters (like that Palisades Fire we just had).

If you’re financial-independence minded, seeing this comparison can be a wake up call.

How the LA fire shook my perspective

If you caught my post about LA fires, I talked about the mental cost of owning a home in a risk-prone area. Even if you’re insured, the emotional weight of “What if my house burns down?” lingers.

And insurance is no longer a guaranteed safety net—many companies have been dropping coverage in Los Angeles.

Personally, if I were to jump on a $1 million LA home, not only would I be paying $5,000/month, but I’d also have the nagging fear of risks that are outside of my control: natural disasters, high insurance (or no insurance coverage), and other phantom costs.

“Don’t confuse consumption with investment”

An asset can generate you money, or lose money and become a liability:

- A pure investment property is something you rent out or flip, expecting returns.

- A consumption property is where you live—lovely to have, but not guaranteed to be profitable after upkeep, taxes, and the occasional $10,000 roof repair.

In L.A., real estate can appreciate—sometimes significantly. That could be a good long-term bet. But monthly cash flow is crucial if you’re in or near retirement.

Here are some ways to unlock the “investment” side of a home purchase:

1. Buy a fixer

In a seller’s market, 99% of the deals means that you’re buying a fixer. There’s something imperfect about the property that allows it to have a lower price. That gives you more financial wiggle room, but renovating the property = money and time.

2. House hack

You can rent out rooms and use that rental income to offset your housing costs. After all, aren’t we all desiring a bit more community? but not everybody’s into that. It mayA million-dollar mortgage at 6%+ interest isn’t cheap. Add in local taxes, potential HOAs, new repairs, and you might be working longer or hustling harder to keep up.

3. Build for rental income

You can buy a multifamily unit (duplex), or consider building an ADU to help offset the mortgage long term. LA, and lot of HCOL dense cities, are friendly to permitting ADUs.

For these strategies to work, you have to really work the strategy. Put in the time to fix a house. Potentially lose privacy and gain the joys of managing tenants.

Even if you can make more money, it’s not for everyone. But I wonder if it’s the only viable option in high cost of living areas.

have your cake and eat it later

I’m looking at about a 3-4 year timeline to buy a home in LA. Since it’s not urgent, my strategy is to wait and rely on investing.

Historically, the market delivers about 8–10% per year on average.

Using the Rule of 72 (72 ÷ 8 = 9), an investment portfolio could double in roughly 7-9 years. So instead of having $1.5 million, that’s about $3 million. With a 4% withdrawal rate, that’s around $10,000 per month in passive income—now that $5,000 mortgage is only half of your monthly FIRE allowance!

Let’s break it down:

Today:

- FIRE portfolio : $1.5 million

- 4% withdrawal: ~$5,000/month

- Mortgage cost: ~$5,000/month

- Result: Your house payment consumes your entire FIRE income.

In 7-9 years (at an 8% annual return):

- Doubled portfolio: ~$3 million. $200K that would’ve been used for downpayment has gone up in value.

- 4% withdrawal: ~$10,000/month

- Mortgage (even if home prices go up modestly, say to $1.3–$1.4 million): still roughly ~$5,000/month, especially if rates drop

- Result: You might have a surplus.

The bet: the stock market increases faster than housing prices.

While the calculation’s not perfect, you might still get to “have your cake and eat it later” by letting your investments grow up.

If the idea of sacrificing early retirement for a house right now doesn’t sit well with you, then consider waiting—let the market do its thing, and when your portfolio doubles, you’ll have a lot more freedom to make that purchase on your own terms.

all of this requires investing skills

Today,I talked a lot about how an investment portfolio, if allocated correctly, could grow to support your life and cover your living costs.

The DIY Investor Course will teach the mechanics of putting together your own investment portfolio + give you the investment mindset to evaluate the big financial decisions in life, like whether buying a house is worth your financial independence.

You’ll see more official announcements of the course this month, but if you don’t want to miss out on $500 worth of early bird goodies, then grab the course on presale.