Hot take: most people looking for help with money should first use a money coach or financial planner, and not a financial advisor.

Today I’ll cover the business model of financial advisors, why they’re too expensive, and what to do instead.

I’m passionate about saving you money, so that’s why I’m offering free financial coaching sessions to help people get a ton of value without paying insane fees.

Beware financial advisors

People who want help with money often go through these steps:

- Thought “I need some advice with my finances.”

- Google search rabbithole leads to “financial advisors”

- Because that role has advisor in it, people naturally think: “Sounds like someone who can give me advice. Which advisor do I pick?”

This path leads to the warm (cash burning) embrace of a financial advisor who will earn lots of fees by doing something simple people can do themselves.

Btw here’s the quick version of “how to manage your own investments,” though don’t consider it “financial advice” (wink wink)

After you’ve set aside enough for an emergency fund (3-6 months living expenses), consider investing in a stock market index fund like VTI and hold for the long term.

While that does oversimplify things, you could do much worse by hiring a financial advisor.

Buying index funds for the long term and applying what I say for free in my beginner’s investing guide will outperform what a typical “financial advisor” will do – charge you a fee for the same strategy, or perform even worse by picking expensive funds.

Now that the secret’s out of the way, I’ll delve into the business of financial advisors and how the industry profits by keeping things complicated.

“Financial Advisor” is a loaded term

There is no exact guideline defining exactly who can be a financial advisor. The lack of standardization leads to confusion as various professionals, all with different motivations, can take on that term.

Let me start with how common these roles are, courtesy of the Bureau of Labor Studies’ 2023 data.

| Financial career | Estimated # of Professionals | Estimated Percentage |

| Insurance Agents/Brokers | 526,700 | 38.69% |

| Investment Managers/advisors | 513,800 | 37.74% |

| Personal financial advisors | 321,000 | 23.58% |

| Total | 1,361,500 | 100.00% |

“Personal financial advisors” is the closest title on the BLS to what most people are seeking: guidance on their finances.

But notice that “investment managers” and “insurance agents” outweigh personal financial advisors by 3 to 1.

- Investment managers can offer you financial advice, but they use a business model that, in my humble opinion, is excessively costly.

- Many financial “advisors” All it takes to sell insurance products is to get a license, and many financial advisors do this to boost their income.

The general public doesn’t know much about these differences, and these costly investment managers tend to have wider reach and visibility.

If you’ve ever seen an Edward Jones or Raymond James office, that’s what I’m talking about.

Effectively, the vast majority of visible “financial advisors” are investment managers and sales people who operate on a fee model that is unnecessarily expensive.

Before you ever interact with a financial advisor or step into one of these retail office locations, I want you to understand their business model.

How financial advisors eat your returns

A financial advisor is almost always working on behalf of a company that makes revenue from managing your money (“assets under management fee”) and selling you financial products.

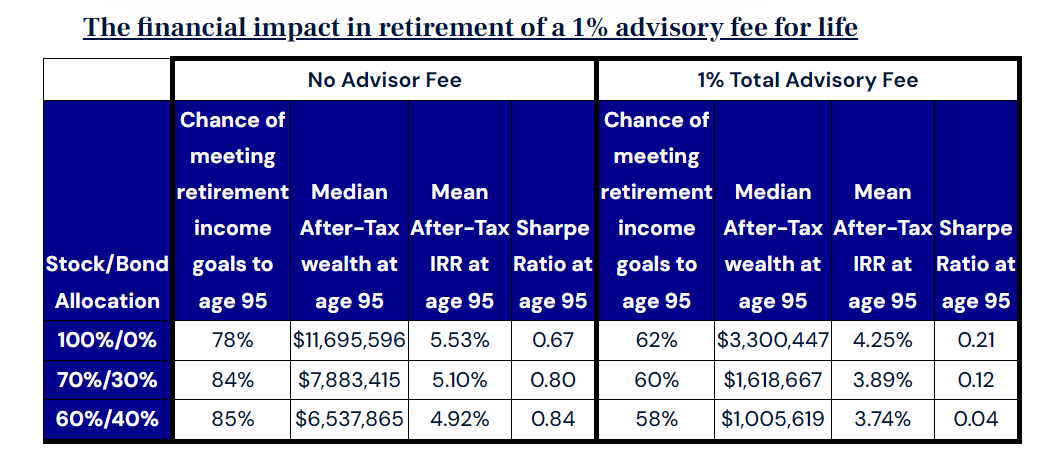

Financial beginners tend to underestimate the impact of percentages, so they might be think that a 1-2% management fee “sounds” low.

The reality is that this is a HUGE amount over time. Take a moment to see the chart below of how even a 1% fee – taken out of your portfolio – may cost you millions over the long term.

And this is just the baseline case.

Working with an investment manager with the “advisor” label may actual cost you a lot more money.

How advisors might threaten your money in FOUR ways:

- They charge a 1-2% AUM fee, sometimes more. That’s money taken directly from you regardless of how your portfolio performs. Stock market down 10% in one year? They’ll still take their fee.

- They may put you in expensive funds. A cheap index product like VTI has an expensive ratio of 0.05%, versus some other funds that are 10 to 20 times more expensive (think 0.5% or 1%)

- They’re encouraged to sell you expensive products you don’t need, most commonly whole life or universal life insurance

- Giving your advisor control of your portfolio removes your skill of DIY investing and managing your own money.

Hopefully I’ve convinced you to avoid the assets under management business model used by many financial advisors.

But you might be wondering: what to do instead if you’re still looking for financial advice?

How to get good financial advice for less

The first question to ask when interacting with a financial professional is about their business models.

Ask:

“Are you a flat-fee advisor or charge using assets under management?”

I highly suggest working with someone who charges a flat-fee model, which just means you pay directly for advice (like most regular services.)

Now, if you’ve never paid for financial advice, a $250 session or $1000 package might feel like a lot up front.

But as I’ve demonstrated with the quadruple threat of working with financial advisors, they’re keen to hide behind how “small” a 1-2% fee might sound.

(I gotta admit—framing their service as an indirect cost that comes out of your investment portfolio is genius.)

The easy solution:

Find a Certified Financial Planner. CFPs mostly charge on a flat-fee basi

There’s a neat free website called Nectarine that lets you browse for flat-fee advisors that charge by the hour.

Since you’re on my newsletter, you can also reach out to work with me.

_ _ _

Now, I am not a CFP nor am I a financial advisor.

Think of me as a coach and tutor to help you on your financial homework.

My focus is on helping you “cross the last mile” of your personal finances and coaching you through step by step how to implement a change, rather than just give you advice.

Here’s my new video explaining how I help.

The hair on the back of your neck might be standing up…if you currently have a financial advisor and you just realized how much they might be costing you.

One thing I can help you do is how to break up with your financial advisor, which is becoming increasingly popular as people become more financially literate.