I’m writing this in March 2025, a volatile time in the stock markets.

It’s easy to say “buy index funds and chill” when the market is doing great.

But the stock market, for any number of reasons, is down:

Political uncertainty.

Trade wars.

Something something AI / unemployment / fill in your anxiety.

I’m not above this fear. It sucks to watch my portfolio go down. But I haven’t changed my investing plan – my dollars are still going into the market every week, buying index funds.

It’s one thing to feel fear. It’s another thing to act out of fear.

In the following guide, I hope to give you a few different perspectives to help you navigate this market uncertainty – and the unavoidable volatility that future will bring.

Stock market psychology

The markets, by nature, do not move in absolutely predictable ways.

(If it did, no one / everyone would make money, all the time).

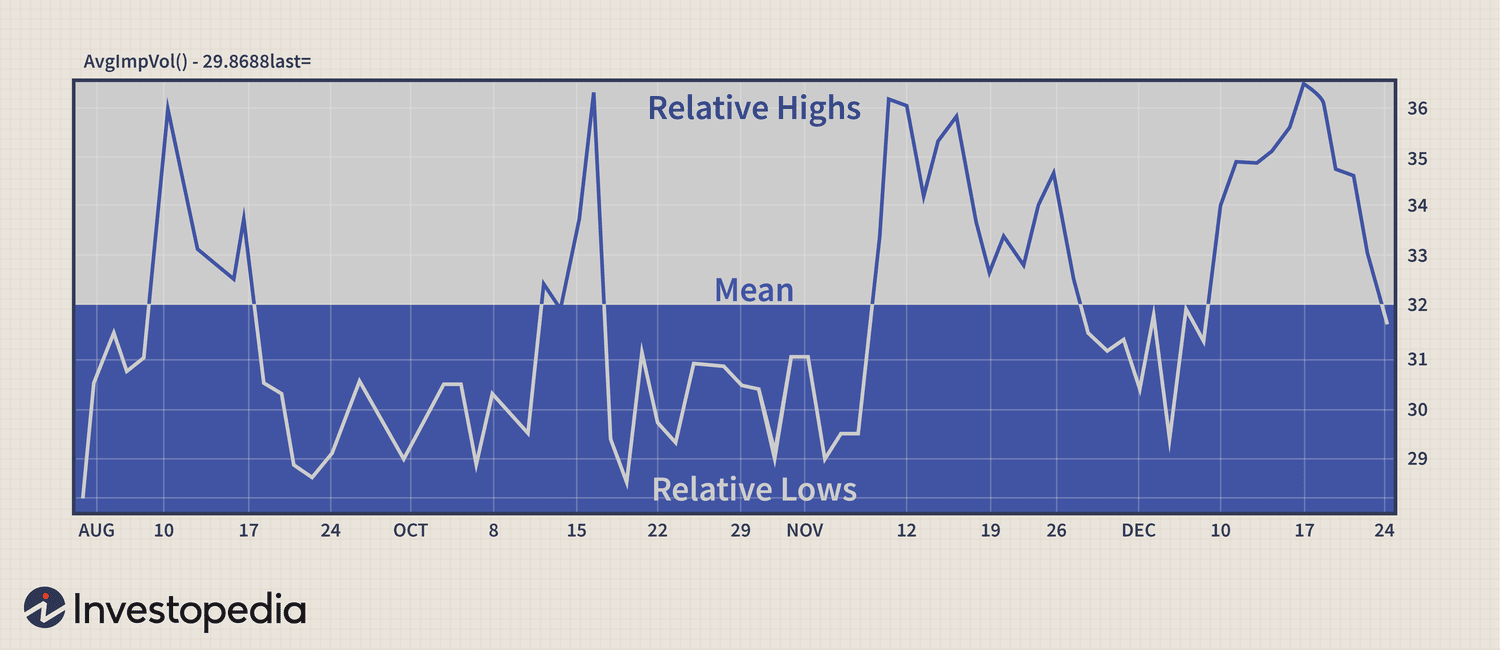

But there are known cycles. How people feel – AKA sentiment – matters a lot.

So much so, that there’s a famous “Fear and Greed” market cycle, as expressed in this chart:

At this moment, we are in the negative trough of sentiment. The current administration is causing a lot of thrash, and the stock market does not like uncertainty. But look at it this way—

- If you were already investing during the optimistic “Greed” curve of the graph, and you sell, then that means you’d have bought high and sold low.

- If you buy at relatively lower prices during market dips (when everyone else panics), then you would be getting a discount on something you were going to buy anyway.

As Warren Buffett famously said: “Be fearful when others are greedy; be greedy when others are fearful.”

But when everyone around you is fearful, it’s hard to do nothing.

What if the market goes down even further?

What if you lose money?

And how long will the pain last?

It helps to zoom out.

Zoom out and trust the data

The first thing to understand is that the stock market is a fluid game – it is not static.

While it has historically returned 8-10% per year, that is an average.

Meaning that investors in VTI, VOO or some stock market index equivalent should expect that the stock market will fluctuate.

Generally, in any rolling period of time, the stock market is up more than it is down.

Stock market performance (1928–2024)

| Time Frame | % of Time Up | % of Time Down |

|---|---|---|

| Any Day | 53-55% | 45-47% |

| Rolling Week | 58-62% | 38-42% |

| Rolling Month | 62-65% | 35-38% |

| Rolling Year | 73-75% | 25-27% |

| Rolling 3 Years | 82-85% | 15-18% |

| Rolling 5 Years | 88-90% | 10-12% |

| Rolling 10 Years | 95-97% | 3-5% |

Those are pretty good odds. Now, let’s see how much stocks fluctuate at any given time.

Standard deviation measures how much returns vary around the average, giving you a sense of the typical range of outcomes.

While stocks can swing widely, here’s what they actually did on average over these rolling periods:

Stock market standard deviation (1928–2024)

| Time Frame | % Up | % Down | Annualized Std Dev | Typical Range (68% of the time) |

|---|---|---|---|---|

| Any Day | 53-55% | 45-47% | 18-20% | -1.1% to +1.1% (daily) |

| Rolling Week | 58-62% | 38-42% | 18-20% | -2.5% to +2.5% (weekly) |

| Rolling Month | 62-65% | 35-38% | 17-19% | -4.5% to +4.5% (monthly) |

| Rolling Year | 73-75% | 25-27% | 17-19% | -8% to +28% (annual) |

| Rolling 3 Years | 82-85% | 15-18% | 10-12% | -2% to +22% (annualized) |

| Rolling 5 Years | 88-90% | 10-12% | 8-10% | 0% to +20% (annualized) |

| Rolling 10 Years | 95-97% | 3-5% | 5-7% | +3% to +17% (annualized) |

The takeaway: volatility is higher in the short term, and lower in the long term. Not only that, but over the long term the typical range of success – the stock market going up – only increases.

- Short-term volatility: Daily, weekly, and monthly periods show higher relative volatility with only 53-65% up rates. Stocks can swing widely (e.g., -20% in a month), but they’re typically within ±5% monthly.

- Long-term stability: Over 5-10 years, annualized volatility falls to 5-10%, and up periods hit 88-97%. The market delivered consistent gains (+10% annualized), rarely dipping below zero over a decade.

You will be rewarded if you treat stock market investing as a long term game, and you will be punished if you treat it like a short term game. Your odds of making money grow if you’re willing to wait.

We got used to a good thing

One reason why the recent market dips feel so painful is because we all collectively got used to the stock market only going up.

In 2024 the market was up almost 24%, and the 5 year period between 2020 – 2025 gave investors a whopping 140% return.

When we’re used to things going well, even smaller dips can feel disproportionately painful.

There is a phenomenon called reversion to the mean, which means that over time, despite big increases or declines, stock prices return to their historical average.

While we celebrate stellar years like 2023 and 2024, we shouldn’t expect that to be the norm.

The “logical” thing is to be okay with the long term averages of 8-10% a year, which means that the stock market cycles have natural tendency to decrease in order to return to its “normal” levels.

When in doubt, let history be a guide.

The options you have anytime the stock market goes down

Still wondering if you should sell your stocks when the market is down? Let’s simplify this into two scenarios:

Scenario 1: You’re still building your portfolio

The easiest thing to do is nothing. Stay the course with whatever investing habit is already in place.

If you want to be more aggressive and have extra cash, then consider that this is a great time to buy more stocks.

Long term investors think of their index funds as everyday goods: “If this is something that I buy regularly, then why wouldn’t I buy more when it’s on sale?”

Ask yourself: Do I usually buy things when they’re at their lowest or highest price?

If you have a large portfolio (congrats), it could feel challenging to keep buying because your losses – on paper – can feel dramatic.

Try this: don’t apply big dramatic moves to your WHOLE portfolio. Just worry about what you would do with the next investable dollar.

- You can pause putting more money into investments

- You can lower the amount that you invest. If you were contributing 20% of your paycheck, maybe it’s now 15%.

- You can increase how much cash you hold, as a buffer.

Scenario 2: You need to draw from your investments to fund your life

Ultimately, the purpose of your investments is to fund your life. So if life throws you a curveball and you need money for it, by all means withdraw what you need.

Ask yourself: What do you need the money for and when?

But if you’re tapping into your investments more frequently than you’d like, this is an indication that you probably didn’t keep enough of a cash buffer to begin with.

Example adjustment: if you were investing 20% of your income and saving 5% of your income in cash, then going forward, rebalance to a more realistic ratio, like 10% investments 10% cash, until you have X months of extra cash saved.

As the saying goes, “Don’t invest more than you can afford to lose”.

This is a test

When markets go down, it’s a test of ALL your investment skills: your financial mindset, your portfolio allocation, and your experience so far in investing.

Have your beliefs about your holdings fundamentally changed?

When you first bought your investment, how long were you planning to hold it?

If you don’t have the right systems in place, you’ll be tempted to sell at the worst times.

Those who succeed have the right beliefs about how the stock market works, familiarity with its cycles, and and the long term mindset that helps them stick to their investment plan with confidence.

If you want to learn how to do all this and more, check out the course I’m building called The DIY Investor.

My goal is empower you with everything I know about do-it-yourself investing to help you build wealth in any market.