Picture this: You’re scrolling social media, and there it is—your high school classmate’s shiny new car, your coworker posted about their promotion, or see nice pics of your friend’s new house.

You feel a pit in your stomach—

You feel behind.

It seems like everyone’s sprinting ahead in life’s race, and you’re stuck at the starting line.

If you feel financially behind, then you’re not alone. This is a universal feeling.

89% of Americans said they haven’t reached their version of financial success; 27% believe they never will.

My goal is to make you feel better about this whole situation. To feel less behind.

I’ll attempt to do that by breaking down the question, word by word…

What does it even mean to “feel behind financially?”

Let’s take the operative word, behind.

Being behind can only happen in a state of self comparison:

- You feel behind relative to your peers. We tend to compare against those in our closest proximity.

- You feel behind relative to expectations of yourself. This is shaped by society and culture.

Let’s take a crack at each one.

Feeling financially behind your peers

I felt financially behind from a young age. Most of my friends had two parent households. My single mother always provided for our family, but I was aware – though I didn’t know these socioeconomic labels at that time – that my family was lower-middle class.

I attended public school in a wealthy suburb of LA, so I was constantly astonished when I saw some of my classmates’ homes. Some lived not just in large houses, but estates. Some of their first cars as 17 year olds were BMWs and Mercedes. Meanwhile, my family was fine, but I still needed lunch vouchers at school. From first grade to graduation, I can count the number of family vacations we took on one hand.

Festinger’s social comparison theory is informative here: generally, we’re unable to judge ourselves accurately, so it’s easier to compare ourselves to other people to form an evaluation. And our brains are work quite logically in this way – we compare most with people in our proximity, who become a “reference group” for us.

That’s why we tend to compare more amongst our peers, than to celebrities and billionaires.

That’s why the phrase “keep up with the Joneses” exists – the Joneses, more or less, represent our next door neighbor.

As I grew up and met more people, I realized that my childhood comparisons of wealth were incomplete.

I met the six figure earners up to their eyes in debt.

Or the couple that sold their nice home because they would no longer afford the mortgage.

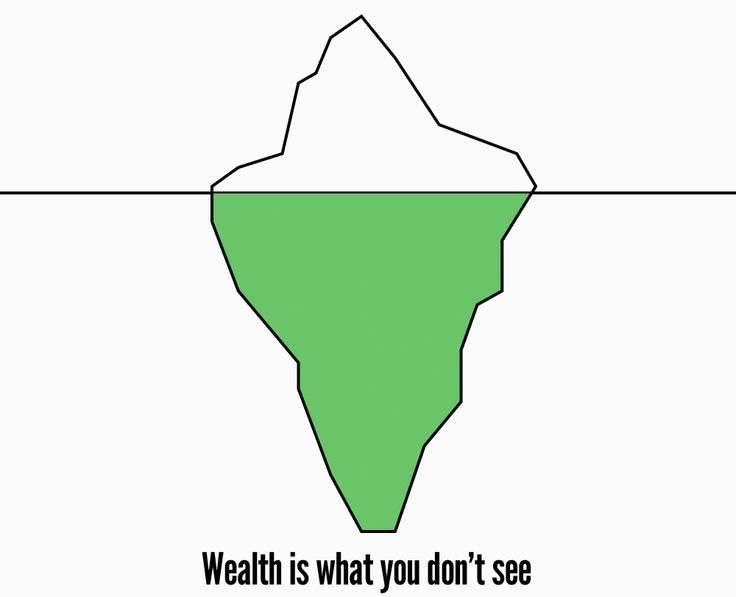

Wealth is like an iceberg…

Think of wealth as an iceberg.

The tip of the iceberg that you see is other people’s spending. Fancy cars, designer bags, tropical vacations.

What we don’t see below the surface represents actual wealth.

Someone has a flashy car, but is behind on their car payments.

Someone looks frugal on the outside, but has savings and sense of financial peace.

If you’re feeling behind your peers, I hope that this perspective shift helps take the edge off. While social media can exacerbate unrealistic perceptions of wealth, wealth is what you don’t see.

Feeling financially behind, based on societal standards

Think back to the rules you might have learned growing up:

Graduate by 22, land a stable job by 25, own a home by 30…

On top of that you might be dating, figuring out your passions, or even starting a family

Welcome to “The Social Clock.”

In the 1960s, psychologist Bernice Neugarten coined the term to explain cultural expectations of when things happen in life. If you’re “off the social clock,” so to speak, then you’re behind in life.

But things change. Today presents a radically different economic landscape. In 1980 a home cost 3 times the annual income and now often costs 7. So there’s a disconnect when today’s youth expect to do just as well as prior generations, while given a different set of variables to in a different economic reality.

Studies show that trying to conform to these broad, societal expectations only increases stress and diminishes life satisfaction.

One antidote: recognize that it’s the social clock – not you – that is behind.

Self-determination theory supports this:

Pursuing goals based on internal values (like autonomy or purpose) leads to increased wellbeing and motivation that lasts longer than external benchmarks like status or possessions.

So how do we reclaim authentic goals? We can ask ourselves questions like:

- Why do I want this? Is it because it truly aligns with my values, or because it looks good on paper—or on Instagram?

- Who set this expectation? Your parents? Your community?

- What would life look like if I designed it around what energizes and fulfills me, rather than around checkpoints that no longer fit the modern world?

It’s all a feeling

Coming back to the phrase I feel behind financially.

I’m staring at the primary verb: feel.

Okay, valid…we can feel behind.

But do we know that we are behind?

Ironically, I’m going to suggest a form of comparison—based on more objective data.

Look at the financial picture of average Americans:

- 61% live paycheck to paycheck

- Average income is $70k/year

- Most save only 4.4% of their income

I hope that’s a good kind of reality check, which suggests progress over perfection.

If you start by saving 5%, then increase it to 10% (and so on), you’ll already be above average.

The point is twofold: we’re all going to compare anyway, so why not include actual, quantitative data for your comparisons?

Qualitative data like looking at your neighbor’s new car is incomplete.

The second point is that you get to choose who and what you compare to.

And I find it helpful to compare up for inspiration, and compare down for gratitude.

- Compare up to be inspired by those who are examples of values that you strive for

- Compare down to feel grateful for what you have, that others don’t have

So long as you avoid comparing in the jealousy, non-productive, messy middle. Why bring that energy to your closest friends and family, anyway?

So…what to do about your money?

Despite these ways to feel less behind financially, you might still feel stuck.

The trick is to start small, and generate momentum in one area of your finances.

My favorite tactic is to focus on building a financial buffer.

Starting by saving 1 month’s worth of expenses.

Pretty soon, you’d have bought months or even years of freedom.

Then move onto higher leverage forms of money, like investing.

Don’t be behind on investing, though…

I’m passionate about teaching people DIY investing because there is one aspect of the “social clock” that is completely bullshit…retiring at 65.

The societal expectation is that you work for 40+ years until you can retire in your 60s. It’s just a totally made up number, an arbitrary milestone.

Unfortunately, more than half of people don’t feel like they’re contributing enough to retirement.

Let’s change that. Learn how to properly invest, and you’ll unlock the ability to retire yourself and your family not only earlier, but on your terms.

But plant your seeds early enough, you won’t need to wait that long to retire.

If you worry, you care

In middle school, we had an eccentric music director named Ms Ragusa.

I don’t know how this question came up in orchestra class, but someone expressed that they were worried about an upcoming concert.

Her response always stuck with me:

“If you worry, that means you care. And if you care, you will get better.”

What a reframe, huh?

If you worry about your finances, then you’re more likely to work on your finances.

And that is much better than the alternative: financial disengagement. Just throwing your hands up, letting the debt pile up, ignoring the situation and giving up.

So yeah, you might feel behind.

But that feeling might just be the catalyst for designing your rich life—not someone else’s.

free TRAINING worth $79

Beat 90% of stock pickers by being lazy.

Learn what to buy in the stock market, how to buy, and dangerous mistakes to avoid.