“Risk tolerance” is one of the most misunderstood concepts in investing.

Today I’m writing about how to hack your mindset so that you can build a portfolio that builds wealth for you, and not be limited by what a financial institution (or advisor) tells you is your “risk tolerance.”

Goal #1: help you realize that risk tolerance is much more fluid than you think.

Goal #2: if you’re younger in investing, please don’t let “risk” scare you.

I regret having so many bonds in my portfolio in my 20s.

If I allocated more to stocks (like I am now, a decade later), my net worth would be much higher.

But that’s besides the point, this post isn’t to bash on bonds (which may come at another time.)

How did I end up choosing to put 40% of my investment portfolio in bonds, in my 20s?

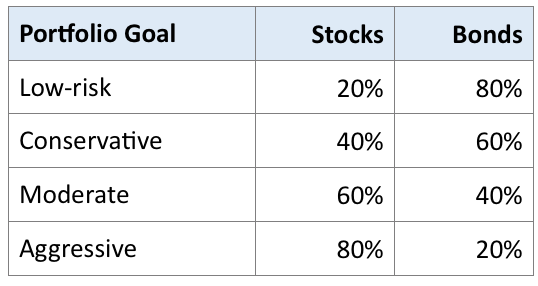

At the time, my investment accounts showed me something like this image below: a recommendation on how “risky” my investment portfolio should be:

I didn’t know any better, so I just thought “a moderate level of risk should be fine.”

So I picked a portfolio resembling the 60/40: 60% stocks, 40% bonds.

Here’s the cumulative growth of $100K between 2010-2020, my investing years:

- 60/40 portfolio: $236,000

- 100% stock (which I regretted not doing): $426,000

I’m not just cherry picking data to say “I could’ve made more money if…” —anyone can do that.

My point is that I was exposed to the idea of risk tolerance in an incomplete way, and thus chose to allocate my money in a way that I wouldn’t now.

So this is the guide I wish I had when I first started investing.

To receive new Money for Human posts and support my work, consider becoming a free or paid subscriber. Gracias!

Risk tolerance is fluid, not fixed

SCENARIO 1

Let’s say two people have exactly the same investment portfolios and were told, after taking an assessment, that they have the same risk tolerance.

The only difference is that Investor 1 checks their portfolio when it happens to be down that week. And Investor 2 checks another time when their portfolio happens to be up that week.

- Investor 1 becomes anxious, seeing that their portfolio lost some value. They consider selling some stocks and buying more bonds for a “less risky” portfolio.

- Investor 2 is pleased to see their portfolio is up. They do nothing; close their laptop and go on with the rest of the day.

Same portfolio. Same risk tolerance. Different behaviors.

The second investor may very well respond like the first investor, if they happened to check their portfolio on a day it was down—or vice versa.

Risk tolerance is tested in the moment of seeing how your money is doing.

Risk tolerance isn’t some unchangeable personality trait that determines how you should invest, forever.

And I think the generic financial advice on this topic is partly to blame here.

Risk tolerance is not all about losing money

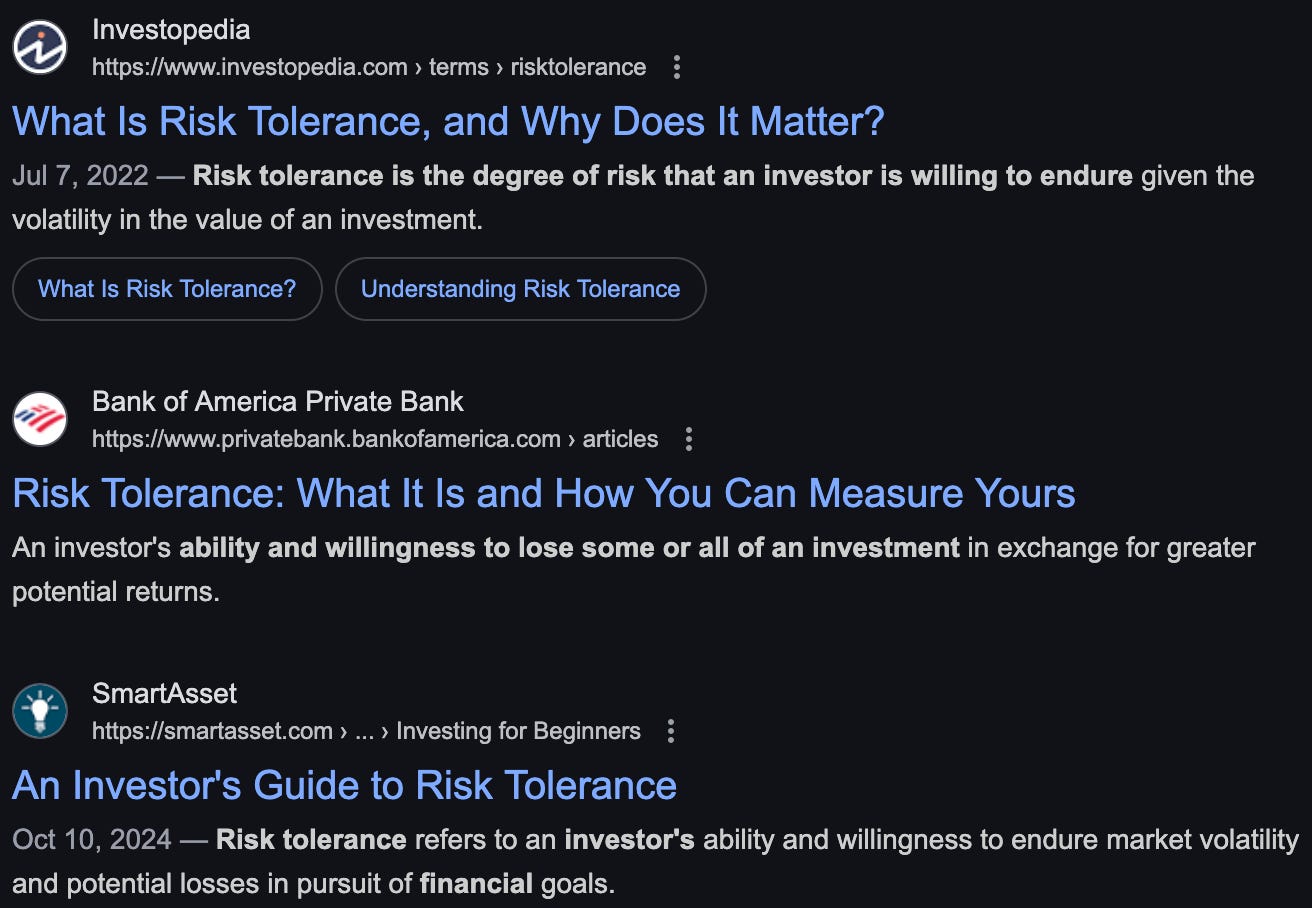

I Googled “risk tolerance” and saw the following first page results:

Notice the general messaging?

It all associates risk tolerance with the idea of losing money.

I’ll highlight another top page result from USAA:

Risk tolerance is a measure of a person’s comfort level with the possibility of their account balances decreasing over any given period of time

Now, why would anyone be comfortable with their account balances decreasing over time?

When risk tolerance is presented this way, of course new investors would default to less risk.

Risk is a feature, not a bug

The S&P 500 index on average returns ~10% per year. But that’s not a static number:

In 2024, the S&P 500 was up an incredible 23%.

2023? Up 24%.

2022? Down 19%.

It is down almost 5% year to date in 2025.

The speed at which assets move up and down like this is called “volatility,” and that’s part of risk.

Let’s play out another scenario.

SCENARIO: GETTING COMFY WITH THE WAVES

Let’s say that your understanding of volatility made you less risk tolerant.

“Stock market goes up and down too much…this seems risky.”

But what if – with a bit of study – you get a “feel” for how the stock market moves?

You start to zoom out.

You start to realize the stock market is like the ocean. The waves (short-term volatility) may be choppy, but the tide (long-term growth) generally rises.

Instead of reacting to what happens in 1 day or a few months, you see that the total stock market relentlessly grinds upwards.

Then you get comfortable with the idea of long term growth and decide to just buy and hold a simple stock market index.

Boom—a bit of financial literacy literally just changed your “risk tolerance.”

Cool, huh?

Risk also works the other way.

That’s why CDs and savings accounts pay ~4% at current interest rates.

It’s predictable and there’s little volatility. Thus you should get rewarded less, compared to the stock market which swings up and down.

All of that to say, volatility should not just be perceived as a uniformly “bad” thing.

Volatility is often why you higher rates of return.

Right info, wrong timing

My fear and intuition is that risk tolerance assessments – and what they lead to in portfolio recommendations – are far too deterministic for a long investing career.

Especially for younger investors.

You don’t want mentally lock yourself into a conservative portfolio like me and lose out on gains just because some risk assessment test led you to perceive risk as bad.

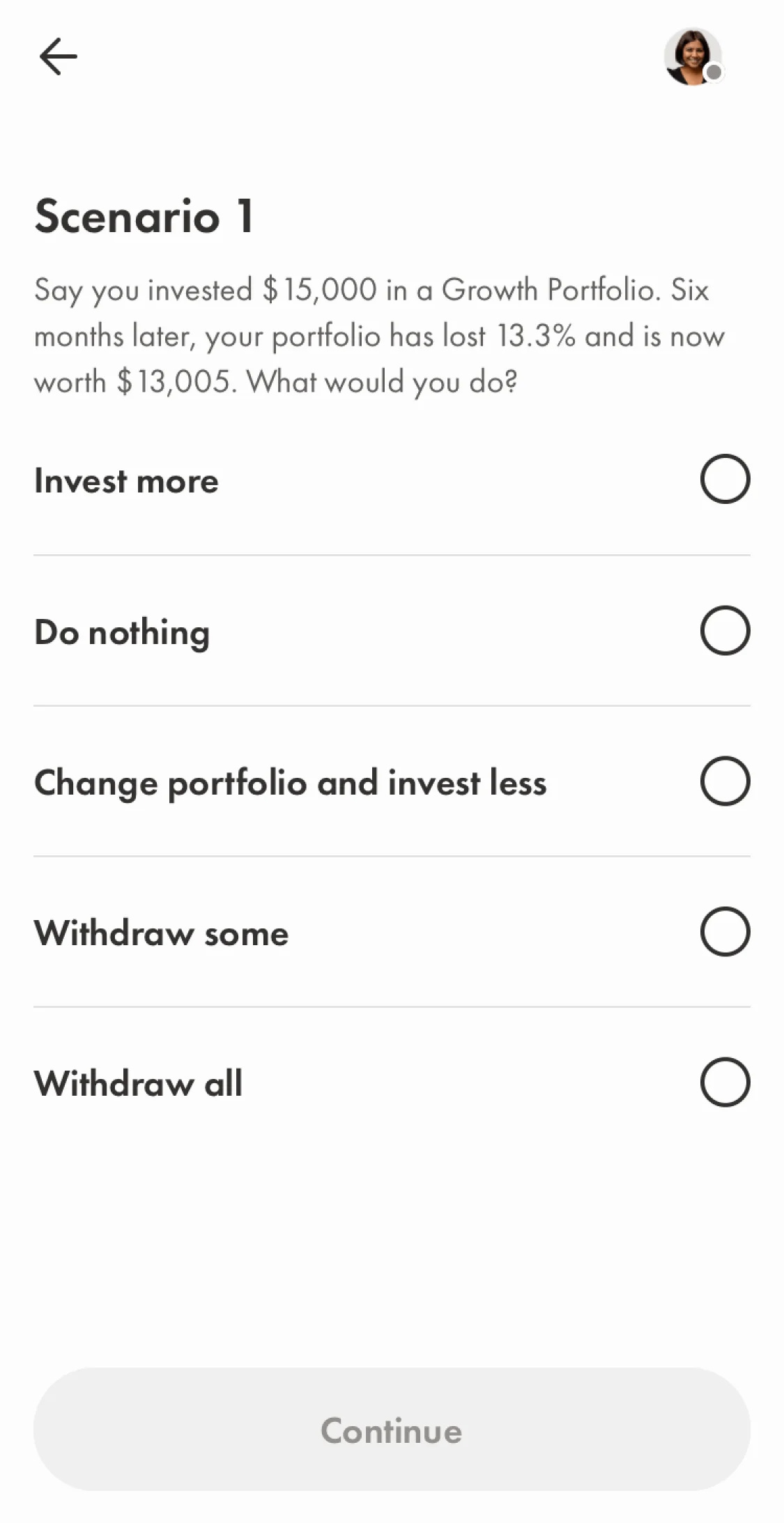

For example, let’s look at how an investing app onboards new users with risk tolerance education:

If the user picks 1 of the last 3 options on this list, the likely outcome is that the app recommends you a more conservative portfolio.

Because you’ve indicated that you’re less risk tolerant and don’t want to potentially lose money (or, gain a lot more!)

Generally I think onboarding experiences like this have a good intention.

But they measure where you are, and not where you want to be.

You don’t want to be locked in thinking “Hey if based on this test I said that I’m not comfortable with temporary 10% losses in my portfolio, then I should stick with this moderate/conservative portfolio.”

What if you want to become more risk tolerant over time; you’re just not comfortable with the stock market yet?

That’s a different problem – and opportunity – than being diagnosed in this moment in time as being uncomfortable with risk.

Younger investors can afford more risk

If it feels like I’m nudging towards more risk, you’re not wrong. But I feel especially passionate about this for younger investors who have the most to gain – or the most to lose – based on their investing style.

Here’s the short 3-point argument for younger investors adjusting their risk tolerance up:

- You have less money invested, and thus less money to lose.

- With a $1000 portfolio, a 10% loss is only $100. Not a big deal.

- Investing habits are hard to change. It’s harder to go from less risky to more risky than the other way around.

- The earlier you start investing with the stock market, the more dramatic the compounding effects will be over time.

A lot of things we haven’t covered

There are a lot of related concepts to risk that wasn’t covered in this article:

- Investing based on age & life stage

- How goals influence how much risk to take

- When to shift from a more aggressive to a more conservative portfolio

I’d love to hear from you if you’d like me to cover related topics, and if reading this shifted your point of view on risk tolerance.

free TRAINING worth $79

Beat 90% of stock pickers by being lazy.

Learn what to buy in the stock market, how to buy, and dangerous mistakes to avoid.