It’s April 7, 2025. My portfolio’s tumbling like a toddler on a sugar high. S&P 500’s down 8-10% from its 6,000 peak.

Nearly $5 trillion of stock market wealth vanished since February.

Trump’s tariffs have the Nasdaq plunging 20%.

In times like this, I look for history as an anchor.

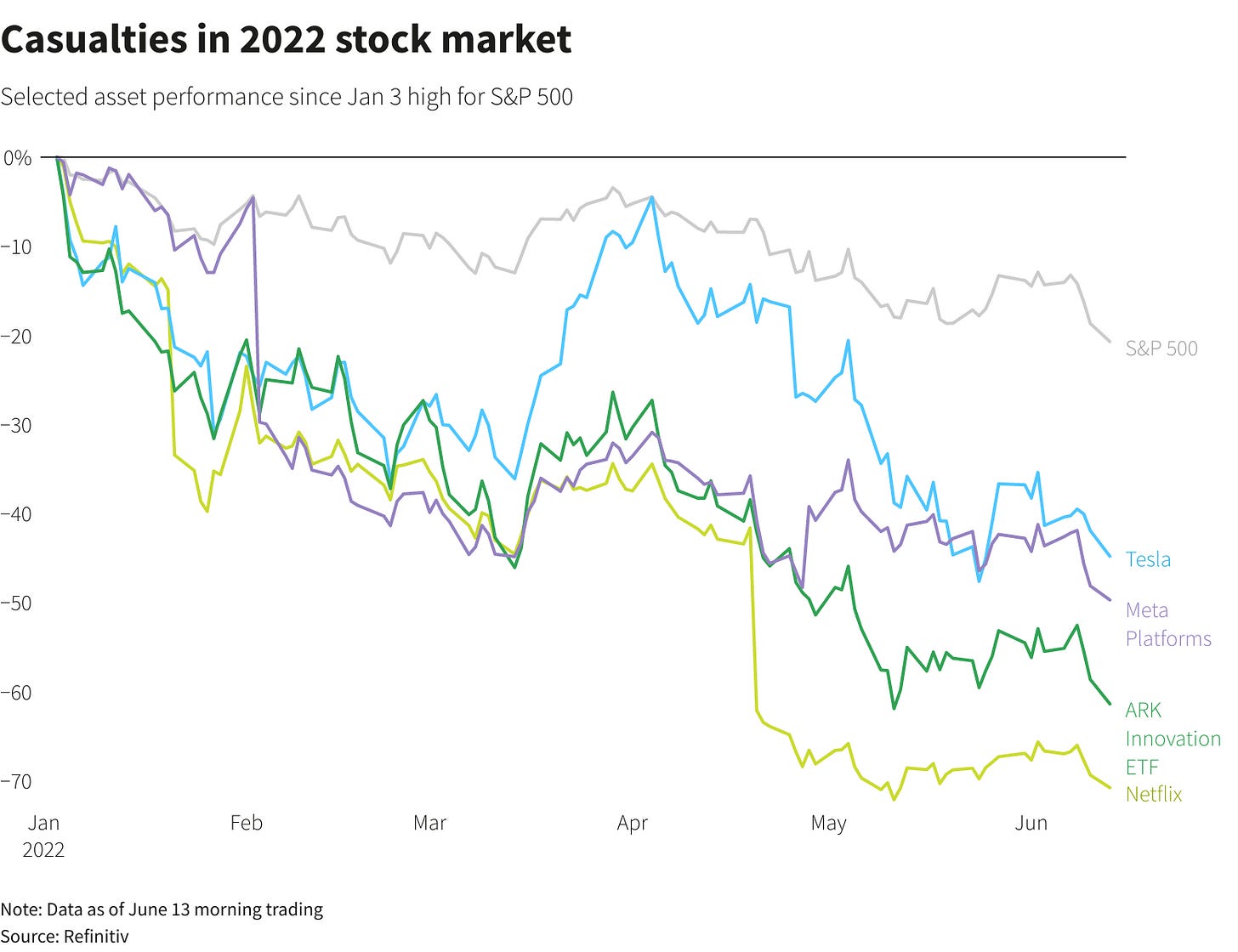

Let’s contextualize the current moment by looking at 2022, the last big shock in the stock market.

I help investors manage their psychology, and mind their money.

2022 vs. 2025: the tale of two tumbles

In 2022, inflation hit 9%. The Fed played whack-a-mole with rates. Macro mayhem.

In 2025, it’s tariffs gone wild.10% on imports, 25% on neighbors. Tariffs Changing by the day.

Trade war roulette.

Comparing the catalysts, now let’s dive into the numbers.

How much did stocks slide?

- 2022: S&P 500 cratered 25.4%.

- 2025: S&P’s down 15%, year to date.

How long was the suffering?

- 2022: The stock market bled slowly for 9 months. The first half of the year was down 21%—the ugliest since 1970.

- 2025: 47 days so far characterized by sharp, stomach-churning drops. It’s not a marathon bleed yet, so let’s cross our fingers for how things play out over 3, 6, 9 and 12 months.

How were portfolios affected?

Looking at a 60/40 stock-bond portfolio…

- 2022: Lost 17%, the worst since the Depression.

- 2025: the same mix was down ~10%. Lighter bruise.

now, the opportunity…

Now, the fun part: 2022’s low—3,577—was a screaming deal.

If you bought then, you’re up 67% by February 2025’s 6,000 peak.

That’s the magic of a big stock market dip. Everyone’s freaking out, but the data whispers, “This is your shot.”

Since 1928, the S&P’s averaged 9.8% a year, crashes included.

Every red screen is a setup for green later.

Yes, 2025 feels like chaos so far.

- Could we hit 2022’s 25% drop (say, 4,500) if tariffs ignite a recession? Quite possible.

- Might the bleeding stop at 15% if things cool down? Maybe.

Butttt either way, 2025 so far is not exactly uncharted territory.

Let’s build wealth together.